If you’ve ever wondered, “Are nutritionists covered by insurance?”—you’re not alone! Many people want to take advantage of expert advice for nutritional guidance but aren’t sure if their insurance will cover it.

In this post, we’ll discuss the ins and outs of insurance coverage for nutritionists vs dietitians, whether you’re looking for help with weight management, chronic conditions, or just improving your overall health. You’ll also learn how to check your specific plan, what to do if you’re not covered, and some ways to save on costs.

Keep reading to find out how to maximize your benefits and make informed choices when it comes to your health.

Are Nutritionists Covered By Insurance?

A nutritionist is someone who offers advice on diet and lifestyle to help people achieve their health goals. The term “nutritionist” is broad, so anyone using this title may or may not have qualifications.

Nutritionists are typically not licensed. Some may have formal education and training, while others might rely on personal experience or short courses.

Because of this, most insurance companies do not recognize them as healthcare providers. Without a recognized credential, insurance providers consider their services elective or non-medical, making coverage less likely.

Are Dietitians Covered By Insurance?

A Registered Dietitian (RD or RDN) is a food and nutrition expert who has met specific educational and professional requirements. They must have a master’s degree in nutrition, pass a national exam, and complete supervised practice hours.

Dietitian services are more likely to be covered by insurance because of their regulated status and expertise in providing medical nutrition therapy for health conditions like diabetes.

Learn more about the differences between nutritionists and dietitians here.

Insurance Policies for Nutrition Counseling

Insurance coverage for nutrition services varies widely depending on the type of plan you have and where you live. Often times insurers provide coverage for nutrition counseling, but it’s tied to specific health conditions.

Coverage for general wellness may or may not be included, so it’s important to check the details of your plan.

Whichever insurance you have, you want to check your specific plan to see what is covered, how many visits you’re allowed per year, if telehealth is covered, etc. It’s helpful to have a list of questions prepared before calling your insurance to verify your benefits.

Types of Insurance Plans

Private Health Insurance

If you have private health insurance, whether or not nutrition services are covered depends on your specific plan. Some private insurers will cover nutrition counseling, especially when it’s related to managing a medical condition like high blood pressure.

However, for general wellness or preventive care, it’s important to check with your insurer to understand the coverage specifics.

Medicare and Medicaid

Medicare generally covers nutrition counseling under medical nutrition therapy for certain conditions, such as diabetes and chronic kidney disease, but only if it’s provided by a registered dietitian.

However, medicare does not typically cover nutrition counseling for preventive care or general wellness unless it’s directly tied to a covered medical condition.

Medicaid coverage varies by state but may cover nutrition services under specific programs, especially if they are related to chronic disease management.

Employer-Sponsored Health Insurance

Employer-sponsored plans may offer more comprehensive coverage for wellness and preventive services, including nutrition counseling.

Some employers also offer wellness programs that include nutrition services, which can sometimes be used alongside your insurance coverage.

HSAs and FSAs

If your insurance doesn’t fully cover nutrition services, you might still be able to pay for them using a Health Savings Account (HSA) or Flexible Spending Account (FSA).

These accounts allow you to use pre-tax money for qualifying medical expenses, which can include nutrition counseling if it’s deemed medically necessary. This can help lower your out-of-pocket costs even if your insurance doesn’t cover your nutrition sessions directly.

How To Find a Dietitian Covered by Insurance

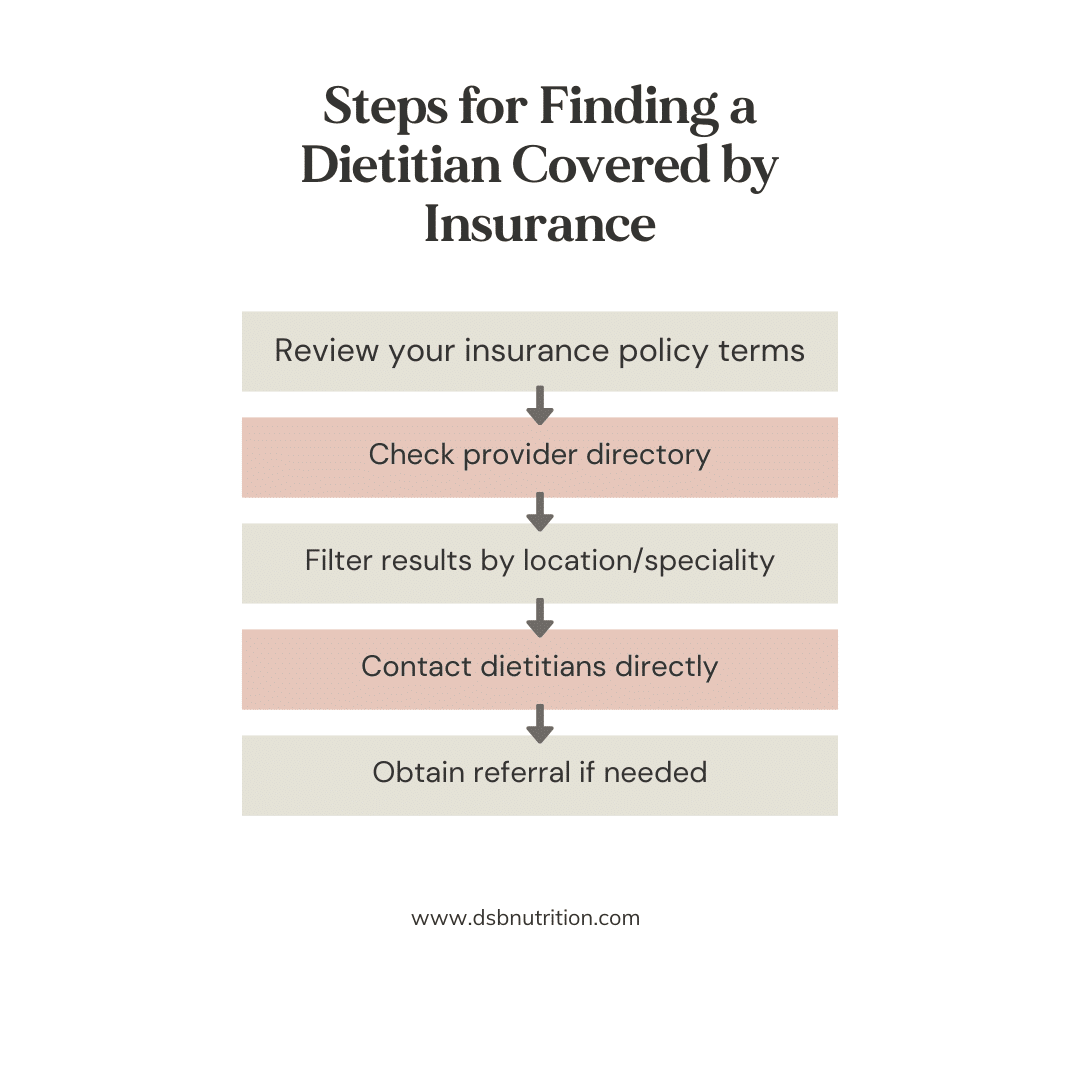

Finding a dietitian who accepts insurance can take a bit of research, but it’s worth the effort if you’re looking to make nutrition counseling more affordable. Here are a few steps to help you locate the right provider for your needs:

1. Check Your Insurance Provider’s Directory

Start with your insurance provider’s directory, which usually lists in-network dietitians. Many insurance companies provide searchable online directories where you can filter providers by specialty and location. Make sure to choose a registered dietitian that matches your specific nutrition needs.

2. Ask for a Referral

Some insurance plans may require a referral from your primary care doctor to cover nutrition services. If you’re managing a medical condition, ask your doctor to refer you to a dietitian in your network. This can help simplify the process and ensure your insurance will cover the visits.

3. Use National Databases

The Academy of Nutrition and Dietetics has a database that allows you to search for registered dietitians in your area. You can filter the results by insurance acceptance, areas of expertise, and more, making it easy to find someone who fits your needs.

4. Contact Dietitians Directly

If you find a dietitian you’re interested in, call their office to confirm that they accept your specific insurance plan. It’s also a good time to ask about any required pre-authorizations or whether they specialize in the type of nutrition counseling you need.

At DSB Nutrition, we accept insurance through Anthem Blue Cross and United Healthcare, making it easier for you to access high-quality, evidence-based nutrition care.

Takeaway

Understanding if and how your insurance covers nutritionist and dietitian services can feel overwhelming, but knowing your options can make it much easier to access expert guidance for your health.

Whether you’re seeking support for managing your weight or a health condition, or just improving your diet, exploring insurance coverage can significantly reduce your out-of-pocket costs.

Starting with your insurance provider’s directory and verifying with dietitians directly are key steps to finding covered services. And if your insurance doesn’t cover, options like HSAs, FSAs, and payment plans can still make nutrition counseling accessible.

At DSB Nutrition, we’re committed to helping you make the most of your benefits, and we accept insurance through Anthem and United. Reach out today to see how we can support your health goals with evidence-based nutrition guidance.

FAQ

What’s the difference between a nutritionist and a dietitian?

The main difference is the education, certification, and scope of practice. A Registered Dietitian (RD) or Registered Dietitian Nutritionist (RDN) is a regulated, licensed professional who has completed a bachelor’s and/or master’s degree, a supervised practice program, and passed a national exam. Dietitians are qualified to provide medical nutrition therapy for managing conditions like diabetes, heart disease, and obesity.

A “nutritionist,” on the other hand, is a broader term with less regulation. Qualifications can vary widely, and the title doesn’t require specific credentials. Some nutritionists may have certifications or degrees, while others may not. Because of the rigorous education and regulation requirements, dietitians are more often covered by insurance.

Why are nutritionists not covered by insurance?

Insurance companies typically cover services provided by licensed healthcare providers, especially when these services are classified as medical. Since the title “nutritionist” is not regulated in most places, insurance providers may view their services as non-medical or elective.

Dietitians, however, have strict licensing and qualifications, allowing them to provide medical nutrition therapy, which is recognized and reimbursed by insurance for treating medical conditions. Without these regulated credentials, nutritionists may be considered out-of-network or non-covered providers by insurance companies.

Should I see a dietitian or nutritionist to lose weight?

If weight management is your primary goal, a dietitian may be the better choice, especially if you have any underlying health conditions, as they can provide tailored, evidence-based support that’s often covered by insurance.

Dietitians are trained to help with weight loss, managing health conditions, and establishing sustainable lifestyle changes. However, if you’re interested in general wellness or non-medical advice, a nutritionist could also be helpful, though you may need to pay out-of-pocket if insurance doesn’t cover their services.

The post Are Nutritionists Covered By Insurance? appeared first on DSB Nutrition.